The Forgotten Municipal Bonds: School Districts

Introduction

December 19, 2023

By Richard A Ciccarone, President Emeritus, Merritt Research Services, an Investortools Company

When it comes to municipal bonds, most of the public as well as researchers and academics usually think of debt issued by states, cities, and large municipal infrastructure entities like airports and municipal utilities. Fewer think of school district bonds.

They should. According to 2022 audit data compiled by Merritt Research Services, an Investortools Company, the total dollar amount of direct debt outstanding by primary and secondary school districts is approximately $450 billion, which is second only to the $600 billion owed by states and territories among all municipal bond credit sectors. There are more than 13,000 school districts in the nation of which about 4,000 are currently estimated to have debt outstanding.

More than likely, the most important reason that school district municipal bond stories do not grab the national public finance headlines or dominate analytical commentary when municipal bond risk or trends are discussed is because of the sector’s historically low default rate since the Great Depression.

With exceptions, school districts are highly secured by a general obligation security pledge backed in the first instance by property taxes. Also, many states provide safety valve protection or oversight that enhances the pledge security and reduces risk.

There is another good reason that helps explain why the school district sector does not get the attention it deserves. Many different school districts – notwithstanding their size – are far from the public eye, except for the families who use the schools themselves. Ysleta Independent School District, TX, is hardly a household name, nationally, yet its $1 billion in outstanding debt is a little more than the total debt for Portland, Oregon.

In a way, the school district sector is a little like being the small cap (small market capitalization) stocks compared to states and cities, which are analogous to the large cap(large market capitalization) stocks. Many school district bonds trade infrequently, which means that the market is not placing real time prices on same security credits anywhere near as often as it does with big corporate or Treasury bonds or stocks. Reduced trade activity hampers price transparency, valuation accuracy and less predictable pricing estimates.

Price levels depend on many factors starting with credit quality and rating (if available), maturity, call provisions, coupon, other structural factors, and state tax-exemption. All these factors must be taken into consideration when analyzing what is behind the trend in price changes for an individual issuer.

Pricing activity for a single municipal bond credit, especially in relation to a benchmark like a AAA rated bond from the same sector, such as for school districts, provides valuable information to the observer about the market’s current view of credit quality of a security. Tracking multiple issues of frequently traded school district bond issues with similar structures can provide an indication of how the market views school debt in general.

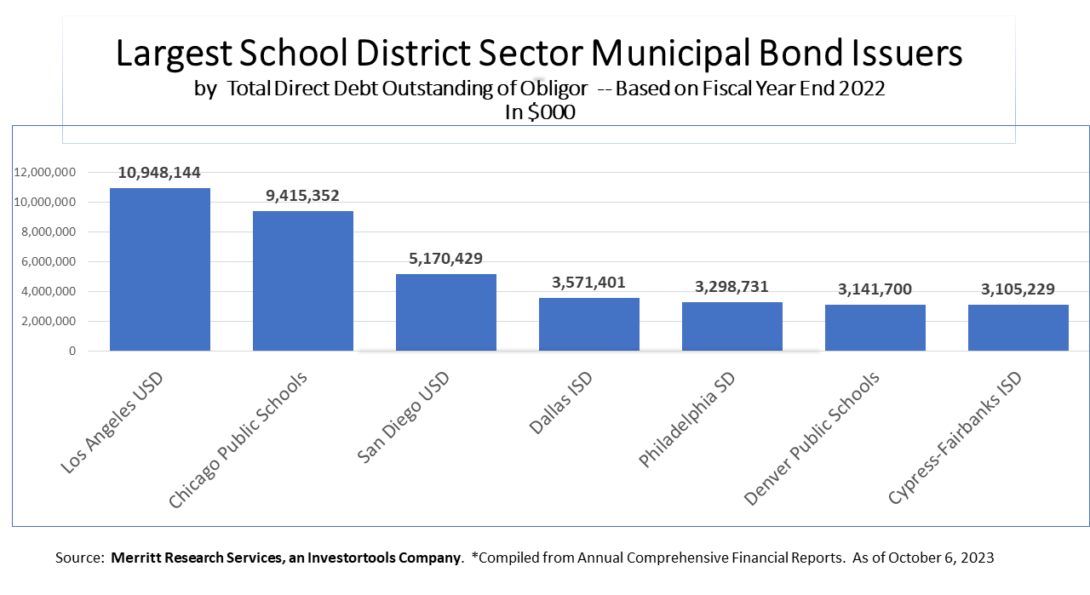

Larger issuers offer a pricing transparency advantage compared to smaller sized bond issuers in the municipal market that trade infrequently. Issuers of a large amount of debt in a single sector can become bellwether indicators for the sector. Amongthe largest municipal bond school district issuers are the Los Angeles Unified School District, CA, the Chicago Public Schools, San Diego Unified School District, Dallas Independent School District, Philadelphia School District, Denver Public Schools and the Cypress-Fairbanks Independent School District, TX.

While increased debt loads typically pose a greater credit risk, it is worth noting that they can also carry a beneficial aspect in terms of trading and pricing dynamics. This is attributable to the heightened likelihood that the market will experience improved price transparency concerning bonds backed by the same credit security. Since all trading activity must be reported promptly to the public through the Municipal Securities Rulemaking Board EMMA database, traders and investors benefit when trades on the same name and security occur more often.

Achieving precise pricing transparency in the municipal bond market is not easily achieved in the municipal bond market even among issuers with the most debt outstanding. Unlike the corporate bond market which structures its debt issuance of a single issuer into a small number of bullet maturities that have all the bonds with the same coupon maturing at same time, municipal bond debt structures commonly have serial maturities, elaborate call structures and sometimes many different niche structures to facilitate short term debt. That reduces the simplicity of tracking frequent trades. Although the informational benefit is diminished, there is still a benefit in seeing the same name trading frequently even when there are structural differences.

The school district sector warrants more attention in the municipal bond market from researchers, journalists, and market makers because it is a core source of bonds, representing around 10% of all debt outstanding. Focusing on larger school district issues and their pricing activity could be a step in the right direction in bringing more transparency to market trends involving this high-quality sector and at the same time raise the visibility of school district bonds in general.

The contents of this blog post reflect those of the authors, and not necessarily those of the GFRC.

About the Author

With over 40 years of municipal bond investment management and research experience, Richard Ciccarone has become a nationally recognized expert in municipal bonds. He has received more than 20 awards and distinctions from Institutional Investor, Smith’s Research & Gradings, Global Guaranty, The Bond Buyer and the National Federation of Municipal Analysts. Institutional Investor named Mr. Ciccarone to its First Team All-American Research Team in the Municipal Bond Research Generalist category, and Smith’s Research & Gradings named him the number one Buy-Side Research Director of the Year on numerous occasions. He has also been honored as an All-Star Sell-Side Research Director, as well as for specialty work in health care, tax-supported debt and bond insurance. He has received career achievement awards by Smith’s Research & Gradings as well as the NFMA.