Estimates of the Early Impact of COVID-19 on Illinois State Revenues

part 1

December 9, 2020

By Kenneth A. Kriz, Distinguished Professor of Public Administration, University of Illinois at Springfield

The year 2020 can be thought of as a play in 4 acts. The first act was relatively stable, if low, economic growth. This period lasted through early March. The second act, beginning then and lasting through the end of May, was the first wave of COVID. Lockdowns, mitigation efforts, the closing of non-essential retail and most entertainment businesses and restaurants wreaked havoc on the economy.

Act three, in the summer and early autumn featured a reprieve and a return to semi-normalcy.

Then we come to the fourth act, which we’re seeing play out now, as the second wave coronavirus hits.. Signs point to slowing growth in economic activity, above trend for the years prior to the COVID, but much closer to trend growth than in the third quarter, with growth picking up only in the second half of 2021 as vaccine distribution becomes general.

The economy’s volatility has created tremendous uncertainty over the prospects for state and local government revenues and their budgets. Early in the second quarter downturn, analysts produced estimates of revenue losses for state and local governments that were dire. Many different sources projected losses of 15-20% of state and local government revenue. Working with a team of researchers from the Institute for Government and Public Affairs, we predicted revenue losses from the “Big Three” state revenue sources – the individual income tax, corporate income tax, and general sales taxes – of between $1.6 billion and $4.8 billion in 2020, depending on the severity of the pandemic.

With an uncertain future confronting states and localities, it is a good time to assess the actual revenue loss created by the first wave of COVID.

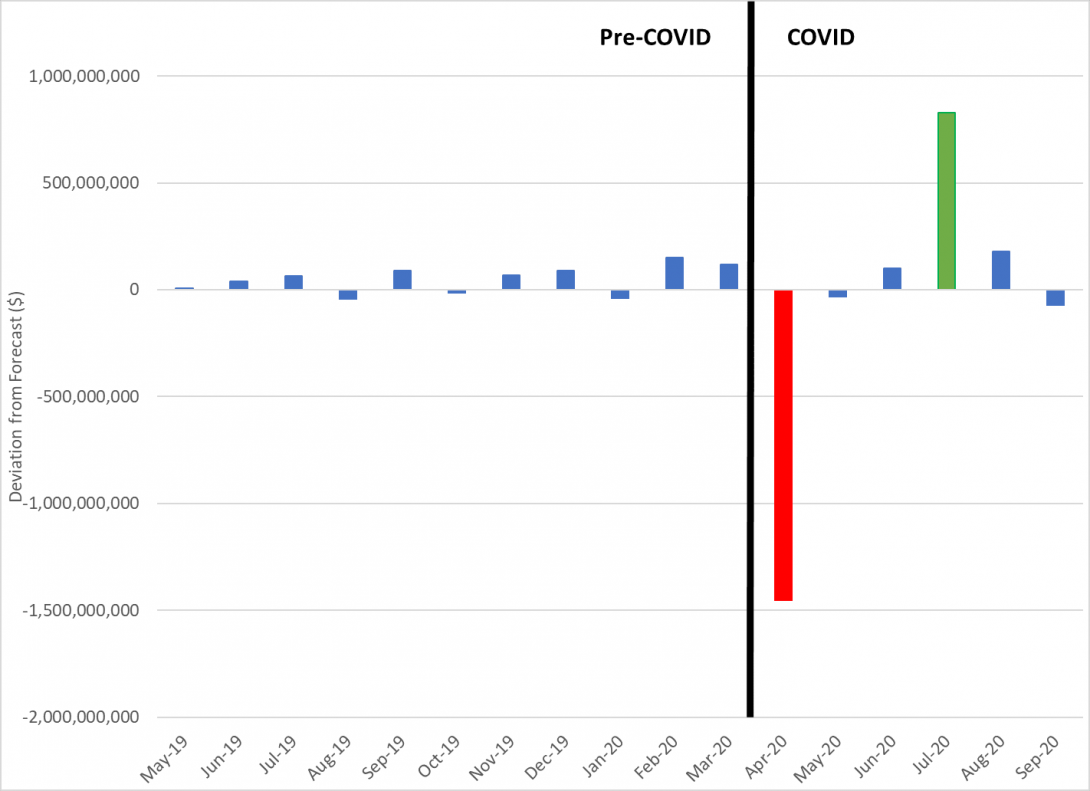

We used monthly tax receipt data from the Illinois State Comptroller and a statistical model called an event study to do this analysis. An event study’s basic idea is to model the pattern of revenues in the period before COVID struck and forecast it into the future. This forecast becomes a “counterfactual” for what would have happened if COVID did not occur. We then compare the actual revenues with the counterfactual revenues, which produces estimates of the impact of COVID on revenues.

Figure 1 captures the logic of our model. The horizontal axis is time, and the vertical axis is the deviation of actual revenues from the forecast. On the graph’s left side, which leads up to COVID (the thick black line), you see that realized individual income tax revenues are in line with the estimates. This indicates a very strong “fit” of the model to the actual data. This strong fit gives us confidence that we have a good model of pre-COVID revenues. In the post COVID period, we see individual income taxes falling dramatically in April. This drop was driven by the economic impacts of COVID and the delayed tax filing deadline imposed by the federal and state government as a form of financial relief. In May and June, revenues were pretty much already back to normal. In July, the surge in tax return filings at the new deadline created receipts greater than expected. After this, the deviation in revenues dissipated, indicating convergence to estimated values.

part 2

We can analyze the revenue impacts as the sum of two periods. The first period is that of April and May. During that time, most of the state was locked down. During that time, our model estimates that individual income tax revenues were $1.5 billion below expectation (Table 1). During the period that followed (which we call the post-lockdown period), the state realized over $1 billion more than expected. This combination of effects leads to a net estimated COVID impact of a $456 million loss in individual income taxes. Sales and corporate income taxes fell by an estimated $200 million and $300 million, respectively, during the lockdown period, but saw no statistically significant rebound in the post-lockdown timeframe. The combined impact of COVID on these major revenue sources was just over $2 billion during the lockdown period, with a net estimated impact of $970 million.

Table 1. Estimates of Revenue Changes Due to COVID, April - September 2020.

| Period/Revenue Source | Individual Income Tax | Sales Tax | Corporate Income Tax | Total "Big 3" |

|---|---|---|---|---|

| Lockdown (April - May 2020) | ($1,490,254,000) | ($213,490,000) | ($301,750,000) | ($2,005,494,000) |

| Post-Lockdown (June - Sept 2020) | $1,033,832,000 | $0 | $0 | $1,033,832,000 |

| Total Effect | ($456,422,000) | ($213,490,000) | ($301,750,000) | ($971,662,000) |

Part 3

The “good” news about these results is that they are better than expected compared to the original forecasts. On a fiscal year basis (fiscal year (FY) 2020 ended in June in Illinois, and FY 2021 started in July), the state has already seen the worst of the budgetary impact. It borrowed $1.2 billion from the Federal Reserve’s Municipal Liquidity Facility (MLF), made inter-fund transfers, and made other changes to withstand the FY 20 storm. Recent releases from the Governor’s Office of Management and Budget and the Commission on Government Forecasting and Accountability acknowledge that FY 21 revenues have been above forecast.

The negative side of the results is that the state could hardly afford any revenue loss. Various sources suggest that it was already running a structural deficit of between $2 billion and $4 billion before COVID. The state covered the deficit by routinely borrowing, not paying bills on time, and transferring from other funds. The state will ultimately have to repay its borrowing (the $1.2 billion borrowed from the MLF in FY 20 will have to be repaid in 2021, and the state just announced it will borrow $2 billion more on a short-term basis in FY 21 from the MLF). Any lost revenue is too much for the state.

Substantial uncertainties remain for state revenues going forward. We have now entered a new wave of COVID infections, and possibilities loom of lockdowns or at least strong mitigations. Negotiations on a new stimulus bill remain stalled in Congress. And economists fear that with some provisions of earlier stimulus bills (like foreclosure moratoria and student loan payment forbearance) due to expire soon, we could be about to see another leg down in the economy. Time will tell whether the 2020 experience will be an isolated problem or the start of an even larger issue.