Property Taxes in Cook County: Introduction to Reform

Project Heading link

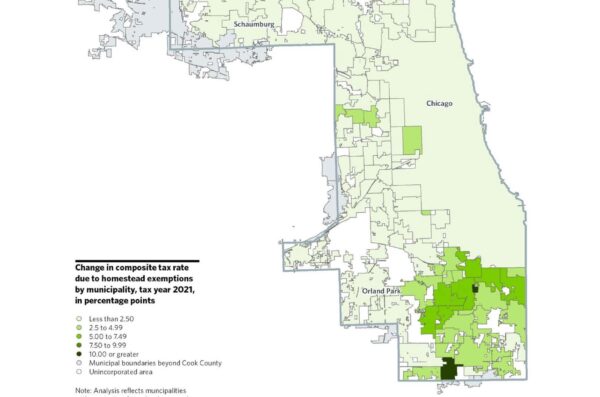

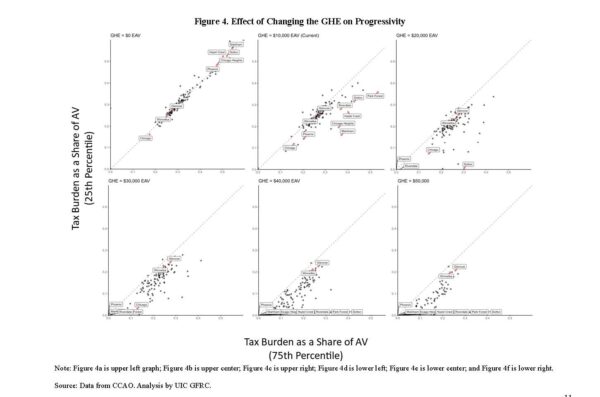

In 2023, the Chicago Metropolitan Agency for Planning and the UIC Government Finance Research Center, on behalf of the Cook County Property Tax Reform Group and with support from the Cook County Office of the President, analyzed homestead exemptions to understand their impacts across the county. This work offers insights on how exemptions can affect taxpayers and taxing districts differently as well as options to mitigate some unwanted effects and enhance homeowners’ savings.

The deliverables so far address two important questions raised by Cook County:

- What are the public purposes of Cook County’s homestead exemptions? How is success evaluated?

- How does the use of exemptions shift the property tax burden between residential and business properties? Between homeowners and renters? How and why do these shifts vary by taxing district?