Estimated Impact of the Cap on SALT Deductions at the Zip Code Level in Illinois

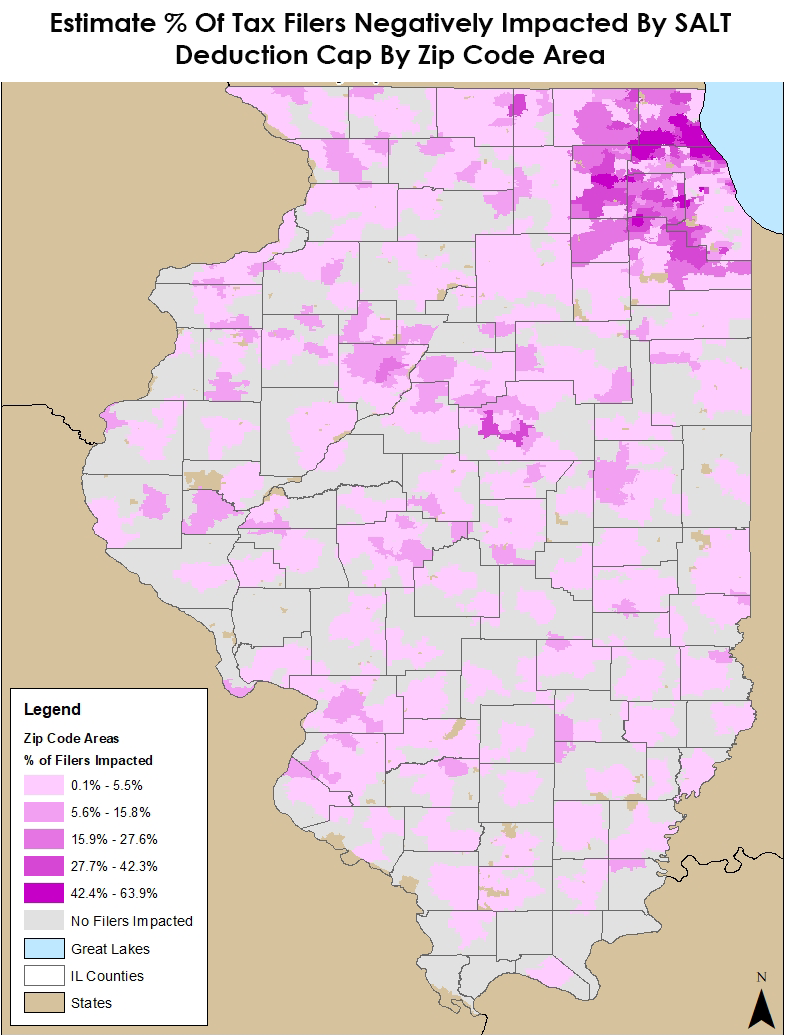

Approximately 15 percent or more of Illinois residents who file federal taxes for 2018 will be impacted by the new cap on state and local tax deductions. Those state residents who are impacted, which could include roughly 1 million tax filers, are likely to be concentrated in adjusted gross income brackets above $100,000 and living in some of the affluent areas in Cook, Lake and DuPage counties. The findings in this report examine Internal Revenue Service data from Illinois' 2015 federal income tax filings to estimate the effect of the new $10,000 cap on federal income tax deductions for certain state and local taxes, known as SALT.

Key Findings Heading link

Key Findings

Impact Image 1

Following are the estimated impacts of the new cap if the cap had been in place in 2015:

- Approximately 15% (or 896,790) Illinois tax filers would have been affected in 2015

- The actual number of affected filers in 2018, the first year when the TCJA went into effect, will most likely be larger because the estimates produced in this report are based on 2015 data, and the increase in the state’s income tax rate from 3.75% to 4.95% in 2017 would most likely increase the number of affected filers;

- The estimated average reduction in income due to the new cap would have been 1.8% (or $2.6 billion) for filers with adjusted gross incomes (AGI) above $200,000 in

- The estimates are the estimated impact of the SALT deduction cap only, not the net effects of the TCJA. The estimates are conservative since the increase in the state’s income tax rate in 2017 increases both the number of affected filers and the amount of SALT deductions per filer in excess of the new $10,000 cap; and,

- The tax filers who would likely see their federal income tax liability increase due to the new cap are likely to be concentrated in the AGI brackets above $100,000 and in municipalities with high property values and high local tax

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000

- Of those 45 zip codes, 11 have more than half their filers who will most likely pay higher federal income

- Of the 1,229 zip codes in Illinois, no taxpayer in 569 zip code areas will feel any financial effect of the $10,000

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000

Impact Image 2

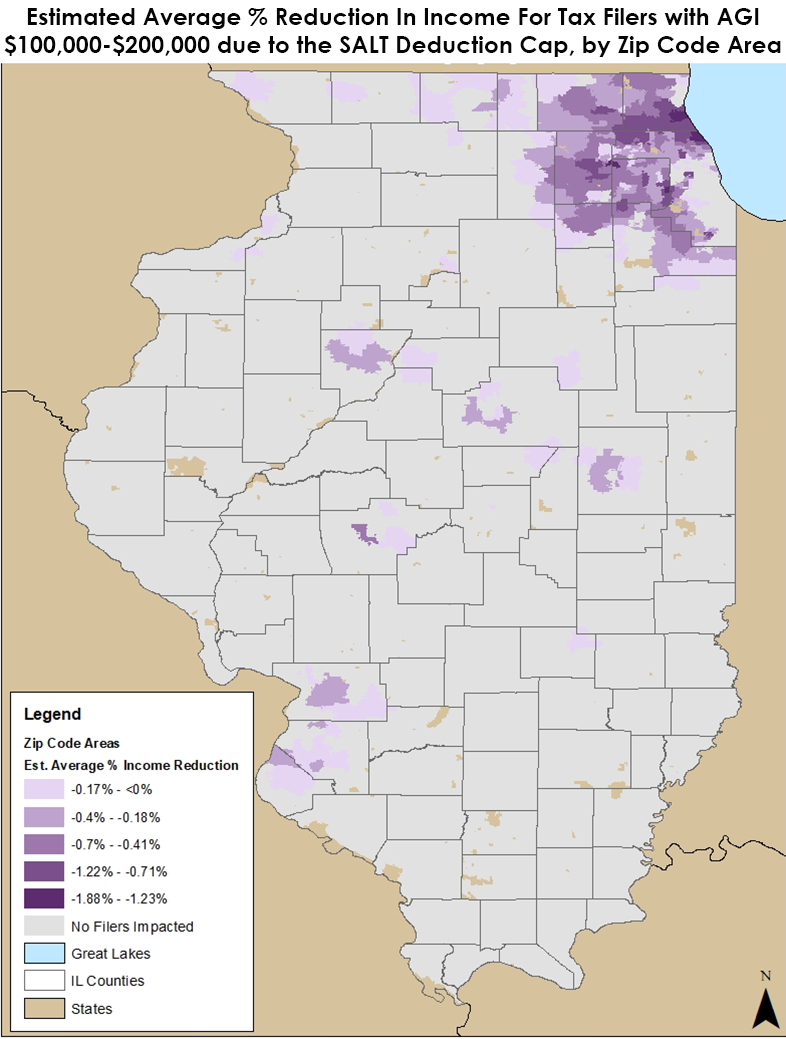

Following are the estimated impacts of the new cap if the cap had been in place in 2015:

- Approximately 15% (or 896,790) Illinois tax filers would have been affected in 2015

- The actual number of affected filers in 2018, the first year when the TCJA went into effect, will most likely be larger because the estimates produced in this report are based on 2015 data, and the increase in the state’s income tax rate from 3.75% to 4.95% in 2017 would most likely increase the number of affected filers;

- The estimated average reduction in income due to the new cap would have been 1.8% (or $2.6 billion) for filers with adjusted gross incomes (AGI) above $200,000 in

- The estimates are the estimated impact of the SALT deduction cap only, not the net effects of the TCJA. The estimates are conservative since the increase in the state’s income tax rate in 2017 increases both the number of affected filers and the amount of SALT deductions per filer in excess of the new $10,000 cap; and,

- The tax filers who would likely see their federal income tax liability increase due to the new cap are likely to be concentrated in the AGI brackets above $100,000 and in municipalities with high property values and high local tax

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000

- Of those 45 zip codes, 11 have more than half their filers who will most likely pay higher federal income

- Of the 1,229 zip codes in Illinois, no taxpayer in 569 zip code areas will feel any financial effect of the $10,000

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000

Impact Image 3

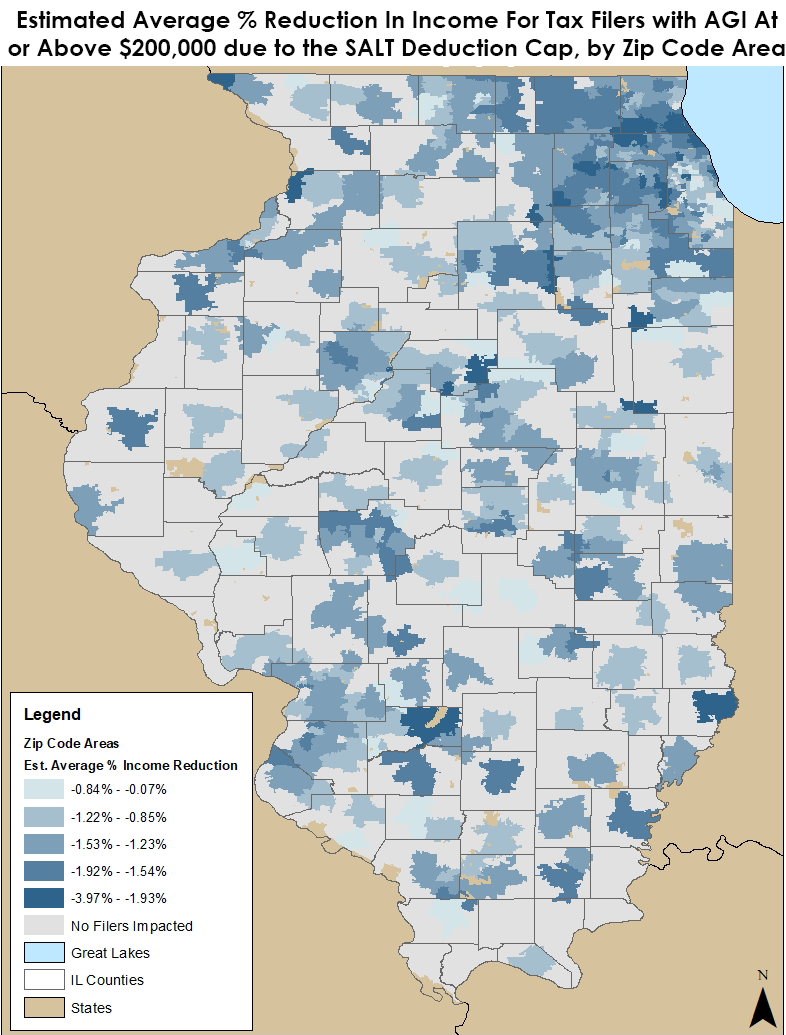

Following are the estimated impacts of the new cap if the cap had been in place in 2015:

- Approximately 15% (or 896,790) Illinois tax filers would have been affected in 2015

- The actual number of affected filers in 2018, the first year when the TCJA went into effect, will most likely be larger because the estimates produced in this report are based on 2015 data, and the increase in the state’s income tax rate from 3.75% to 4.95% in 2017 would most likely increase the number of affected filers;

- The estimated average reduction in income due to the new cap would have been 1.8% (or $2.6 billion) for filers with adjusted gross incomes (AGI) above $200,000 in

- The estimates are the estimated impact of the SALT deduction cap only, not the net effects of the TCJA. The estimates are conservative since the increase in the state’s income tax rate in 2017 increases both the number of affected filers and the amount of SALT deductions per filer in excess of the new $10,000 cap; and,

- The tax filers who would likely see their federal income tax liability increase due to the new cap are likely to be concentrated in the AGI brackets above $100,000 and in municipalities with high property values and high local tax

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000

- Of those 45 zip codes, 11 have more than half their filers who will most likely pay higher federal income

- Of the 1,229 zip codes in Illinois, no taxpayer in 569 zip code areas will feel any financial effect of the $10,000

- Of the 1,229 zip codes in Illinois (data are available only by zip code, not by municipality), 45 have more than one-third of their filers who will most likely pay higher federal income tax due to the new $10,000